Speech by Mr Jairam Ramesh Minister of State for Commerce and Power Government of India

Briefing Theater I, Office Tower Block Asian Development Bank, Manila 24 November 2008

Invited Lecture delivered at the Asian Development Bank, Manila November 24th, 2008. Views do not necessarily reflect the views of Government of India. Comments of Shivshankar Menon, T.S. Tirumurthi and Srinivas Madhur on an earlier draft and inputs from Nagesh Kumar are gratefully acknowledged.

I

I have been asked to speak to you on India and Economic Integration in Asia. Before I do so, I should acknowledge that India and Economic Integration within India is a more pressing task needing realisation at the earliest. It took India over a decade and a half to move to a VAT regime and even today we have a national VAT and a state-level VAT. Three years ago, India’s Finance Minister announced that India will move to an integrated goods and services tax by 2010. If this deadline can be kept, the goal of an Indian Common Market will be finally realised very substantially.

Four months before India attained freedom sixty one years ago, Jawaharlal Nehru hosted an Asian Relations Conference in New Delhi. 28 nations participated. This demonstrated the profound commitment our Founding Fathers had to the cause of regional integration in Asia. Subsequently, India played a key role in the resolution of the crisis in the Korean peninsula, in the peace conferences in Indo-China and in peace- keeping in West Asia. And is well known, at Bandung over half a century ago, India along with China and Indonesia strived hard to forge a solidarity among the new nations of Asia.

I start with this little bit of history just to reinforce the point that India has always seen itself as an integral part of Asia, even if in ASEAN and other capitals, Asia has been seen to be ending in Myanmar. But that is past. India is now seen to be a full-fledged Asian power and for this the immense contributions of the former Prime Minister of Singapore Goh Chok Tong must be acknowledged. More than anyone else, it was he who engaged India and championed India’s cause in Asian forums in the 1990s when India’s own Look East policy was taking shape. It is not a coincidence that India’s very first Comprehensive Economic Cooperation Agreement (CECA) was signed with Singapore three years ago.

A sign of the changed environment is that India’s Prime Minister Dr. Manmohan Singh travels to Chiang Mai in a few weeks to sign the India- ASEAN FTA on December 17th. This pact is not just an economic agreement. For India it is also a political statement, a declaration that India is prepared to pay a short-term price for achieving the longer-term objective of integration with ASEAN.

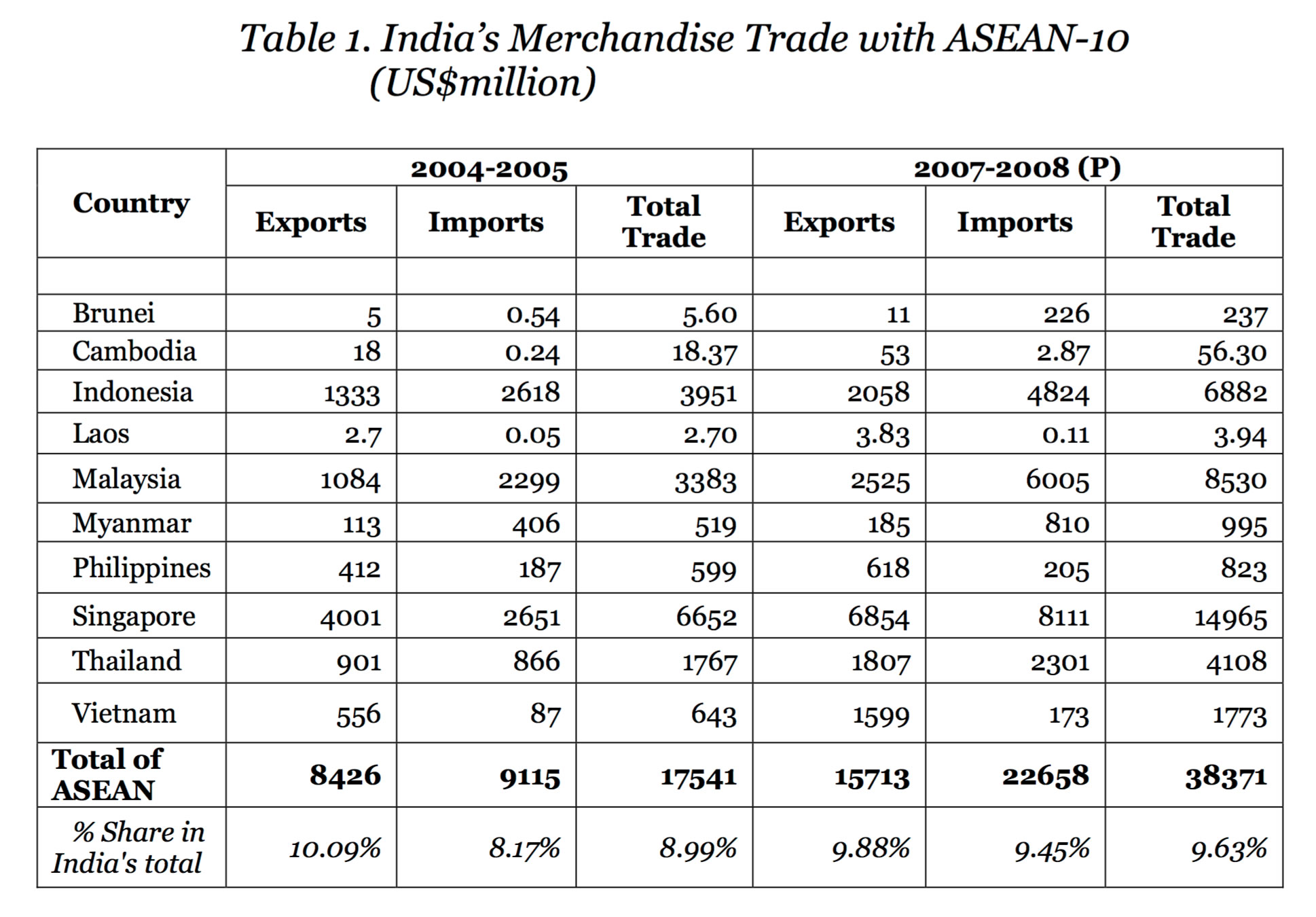

The FTA has taken five years to negotiate. India has been extraordinarily flexible on a variety of issues like rules of origin, value-addition norms, and negative lists. For a country that enjoys a substantial trade deficit with ASEAN—India’s exports to ASEAN in 2007/08 were around $ 16 billion and imports about $ 23 billion as the Table below shows—and for a country that is expected to gain less from a FTA in goods alone, the event in Chiang Mai is indeed a watershed. Its extension to cover services and investment as well is something that India hopes will be accomplished quickly.

II

The immediate neighbourhood of India is, of course, South Asia and so let me begin from here. After some years of slow progress, SAFTA—the South Asian Free Trade Agreement—has moved forward briskly in the past two years. Afghanistan has just become the eighth member (and Myanmar has been accorded observer status in SAARC). What is noteworthy is the approach of India—an approach of unilateral action without always insisting of reciprocity. Let me give a couple of examples.

First, India has slashed import duties to zero, a full year ahead of schedule, for all tariff lines not on negative list for the five LDCs in South Asia—Nepal, Bhutan, Afghanistan, Bangladesh and Maldives. Second, it has pruned the negative list for these countries from 744 to 480 at one go. Third, it has given special TRQs for garments to Bangladesh and Sri Lanka that will boost the export earnings of these two countries by at least $ 60-70 million per year. Fourth, it has initiated a serious exercise to address the concerns on non-tariff barriers—both real and perceived– expressed by Pakistan, Bangladesh and Nepal most of which relate to standards and certification procedures. 50 such NTBs have been identified and each one of them is being subject to scrutiny. On standards, we are entering into mutual recognition agreements and making use of accredited institutions in our trading partner countries themselves.

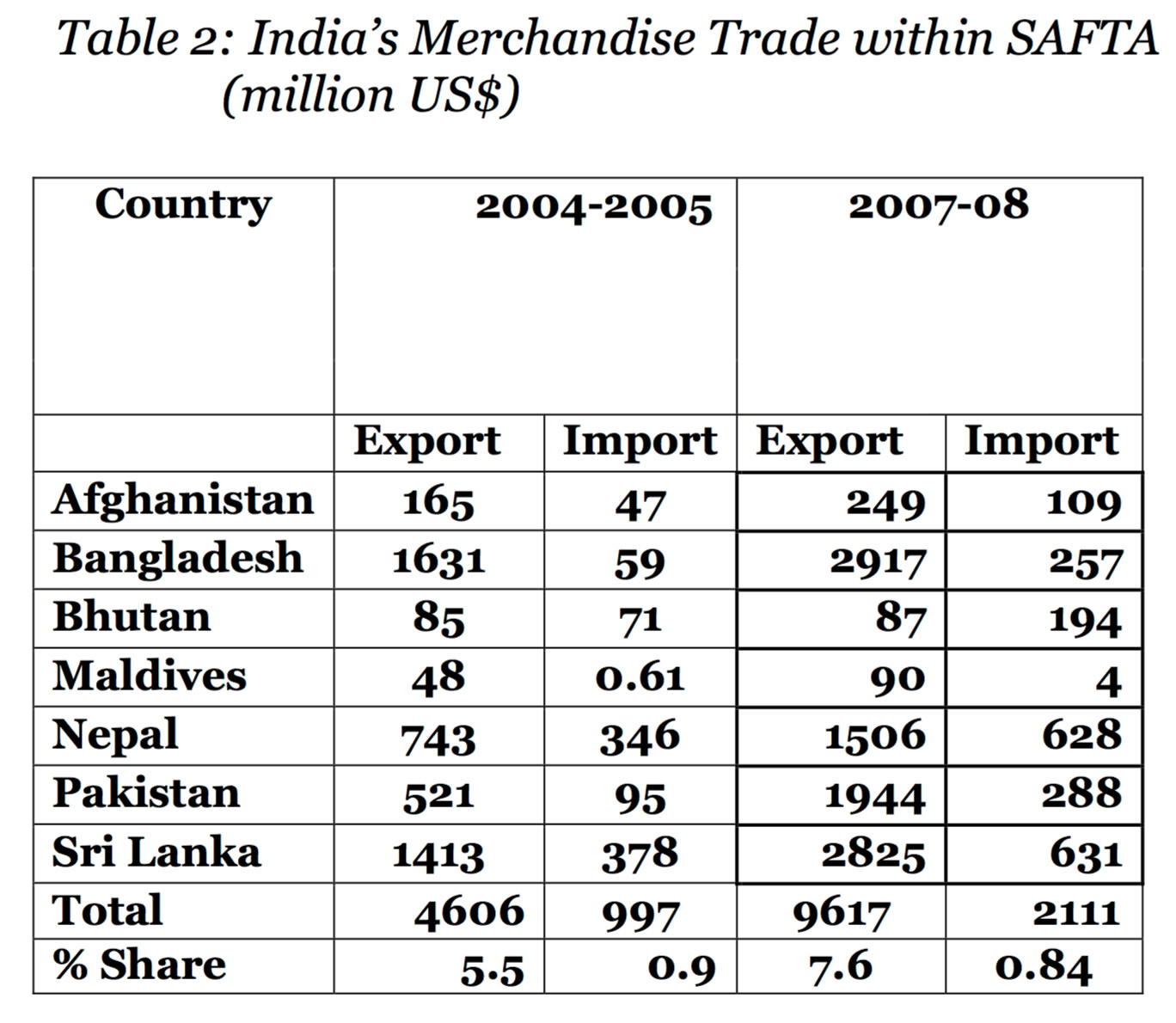

I am glad to say that SAFTA is on course and a decision has already been taken to expand it to cover services as well at the earliest. Barring Bhutan, India enjoys a substantial (and growing as well) trade surplus with all its SAFTA partners as the Table below will show.

The case of Sri Lanka invites particular comment. Ten years ago, India’s exports to Sri Lanka were ten times its imports. Now, the ratio is around 5:1. India’s trade surplus is no longer a political hot potato in Sri Lanka as trade ties have expanded following the India-Sri Lanka FTA signed in April 2000. This FTA has stimulated substantial Indian investment in Sri Lanka. These investments have, in turn, resulted in increased exports from Sri Lanka to India. This growing engagement led both countries to initial the Comprehensive Economic Partnership Agreement (CEPA) in July this year. There are additional spin-offs. Connectivity is at an all- time high and Indians have become the largest tourist group in Sri Lanka. Nepal too is exporting more to India than Bangladesh and Pakistan are doing almost entirely because of Indian investment there.

Unfortunately, Indian investment in Pakistan is prohibited and is severely restricted in Bangladesh. On our part, we have, last October, removed Bangladesh from the list of countries from where FDI was prohibited on security considerations. I am hopeful that we can do this for Pakistan as well in the next few months. Investment opportunities for Indian companies in these two countries are substantial. But then in South Asia, politics has never been very far and economic rationale by itself has not been enough. These countries will also have to overcome their reticence to engage with India at a political level before we can translate desire into action. Investment will not be just a one-way flow. Sri Lankan companies are undertaking major investments in India in areas like textiles, biscuits and furniture. Bangladesh companies have evinced interest in investing in India in areas like food processing, pharmaceuticals and paper. I am convinced that faster investment liberalisation will bring all-round benefits and strengthen the SAFTA regime itself.

Connectivity is the main challenge right now in South Asia. The ADB itself has prepared a most useful Regional Multimodal Transport Study and this detailed blueprint has been under discussion in SAARC forums for the past two years. It is clearly time for some of the more critical projects identified in this study be taken up for actual implementation both bilaterally and multilaterally. India has just embarked upon a major project to upgrade infrastructure at thirteen land customs station—one on the Pakistan border, four on the Nepal border, seven on the Bangladesh border and one on the Myanmar border. This project will be implemented over the next three years at a total cost of around $ 200 million. It will greatly facilitate trade and movement of both goods and people as well.

But more certainly needs to be done. The narrow concept of “border trade” has to be replaced by a larger concept of “MFN trade at the border”. This is particularly true along India’s borders with Pakistan, China and Myanmar which are based on positive lists. We have made a beginning with Myanmar and our two countries have agreed to move to normal trade at the Moreh/Tamu land customs station. We are also engaged in talks with Bangladesh and Myanmar to revive the centuries- old concept of “border haats”, that is border bazaars based largely on barter.

I should say here that India looks at electricity as a key element of regional integration in South Asia—synergy through energy, so to speak. We have embarked on creating an interconnection between the Sri Lankan and Indian power grids. India is already drawing 1400 Mw of power from Bhutan (earning for that country of about 0.6 million a revenue of around $ 250 million in 2007/08). This is to increase to 10,000 Mw by 2020. A couple of projects are on the anvil in Nepal—ADB itself is looking at financing the 750 Mw West Seti project—that will sell power to India. This will call for very substantial augmentation of transmission capacity between Nepal and India.

India has just signed a MOU to develop projects in the Chindwin River Basin in Myanmar and this too will require the two grids to be interconnected. India has just very recently offered to Bangladesh the opportunity of linking the power grids of the two countries. The World Bank is examining a project that brings power from Turkmenistan to Afghanistan and Pakistan and perhaps to India at some later stage. The building blocks are bilateral and once the politics in the region allows it, there will, I am sure, be a seamless transition to a totally regional grid of the type that exists in North America or Europe.

While on South Asia, I should mention that even though Pakistan has not extended MFN status to India, a most basic requirement of international trade, India has moved ahead with expanding trade ties with her immediate western neighbour. For the first time in sixty years, the two countries have started trade across the line of control in Jammu and Kashmir, albeit restricted to twenty one items of common interest to begin with. Modalities for the opening of the old Skardu-Kargil route will be discussed soon. India has begun importing cement from Pakistan and over the past year, something like 0.7 million tonnes worth around $ 75 million have either been purchased or have been contracted for.

This is a small but important beginning. A number of trade facilitation measures have been finalised and should see the light of day soon. Even so, trade between India and Pakistan is not only substantially below its potential both ways but trade between the two countries via countries like Dubai perhaps exceed the volume of official trade. India and China have been able to separate political and economic issues in a pragmatic manner following the historic meeting of Deng Xiaoping and Rajiv Gandhi in December 1988. India and Pakistan await a similar breakthrough. However, I should mention that the recent meeting between President Zardari and Prime Minister Dr. Manmohan Singh in New York two months back was hugely transformative. The two countries have agreed to have trade in all permissible items (1938 as declared by Pakistan) across the Attari-Wagah land customs station in both the Punjabs, up from the present thirteen items. In addition, agreement has been reached between the two leaders to permit movement of all permissible items by rail through Khokrapar-Munabao that links Rajasthan with Sind.

It is now an acknowledged fact that the perennial flooding problems affecting millions year-after-year in Indian states like Uttar Pradesh and Bihar cannot be solved without closer cooperation with Nepal. Similarly, the full economic potential of India’s north-eastern states cannot be realised without the full involvement of Bangladesh. But it is indeed a matter of considerable frustration and disappointment to people like me who see themselves as South Asia-ists (those who believe that India’s globalisation should embrace, not bypass South Asia and that India should be prepared to take unilateral steps in this matter), that even after seeing the example of Bhutan and Sri Lanka, some of our neighbours continue to be tepid in their responses to India’s overtures, smelling a conspiracy that simply does not exist. India’s relative economic muscle and demographic might cause understandable uneasiness amongst its neighbours. One way forward could be to create new institutional mechanisms under SAARC which enable India’s border states to interact and cooperate with their South Asian country neighbours.

III

Just a couple of days back, India hosted the 2nd BIMSTEC Summit in New Delhi. BIMSTEC straddles both South Asia and Southeast Asia and that is its significance. Myanmar primarily and Thailand will our bridge to the East Asia. BIMSTEC’s importance goes well beyond a FTA in goods that will, in itself, serve to supplement both SAFTA and the India- ASEAN FTA. At the Summit, Prime Minister Dr. Manmohan Singh spoke about developing maritime transport infrastructure and creating shipping and logistics networks, apart from cooperative mechanisms to harness marine resources. In addition, the “B” in BIMSTEC could well stand for Buddhism—the fostering of a Buddhist circuit would exploit a comparative advantage of this grouping.

I spoke of the India-ASEAN FTA earlier. India’s participation in both BIMSTEC and ASEAN is broadly called India’s Look East policy that was initiated in the early 1990s. The main impact of India’s Look East policy, it is now widely recognised, should be felt primarily on India’s eight north-eastern states that are very well endowed in natural and human resources but whose full development potential has been stymied by the burdens of both history and geography. I have long argued that the economic future of these states is intertwined with that of ASEAN especially even as their political anchor remains in India. India’s Look East policy starts with India’s northeast. A number of initiatives are under implementation and discussion for furthering trade and investment between our northeastern states and their neighbouring countries.

A recent study done by a well-known think tank called RIS in New Delhi which works as part of a network of Asian research institutions has estimated that Bangladesh could earn over a billion dollars per year as transit-cum-transhipment revenue between Kolkata and this region of India. India has also suggested several ways for greater connectivity with and through Bangladesh. I myself was in Dhaka recently and conveyed India’s desire to conclude a limited package deal that could be politically saleable in Bangladesh as well. India is now implementing the $ 150 million Kaladan multimodal transit-cum- transhipment project at Sittwe (the old Akyab port) in Myanmar which will open an alternative access route to India’s northeast.

There has also been some discussion on reopening the historic Stilwell Road that starts in Assam and goes through Arunachal Pradesh, Myanmar and on to Kunming in China’s Yunnan Province. This has many ramifications going beyond simple connectivity and the proposal is being studied in its entirety. In addition, India is seriously pursuing the India-Myanmar-Thailand highway. The Tamu-Kalewa stretch of this road has already been built by India and this has helped opening of trade between some of our northeastern states and Myanmar. Indeed, I should point out that much of our expanded engagement with Myanmar in recent years is not so much to counter China as is often portrayed in the media but to improve the economic fortunes of our resource-rich northeastern states and India’s connectivity with Southeast Asia itself.

IV

India is in the cockpit of Asia as it were. Around it is South Asia. To the right is East Asia. And when you look north, we encounter Central Asia. India’s Asia strategy has embraced this region as well, a region with which India has had a long cultural and historical relationship as well. As I mentioned earlier, Afghanistan is now a full-fledged member of SAFTA and thus South Asia and Central Asia have been drawn ever closer together. India has tried to establish a foothold in the hydrocarbon economy of Kazakhstan but barring the example of the expatriate Indian Laxmi Mittal, it has not been very successful. It has been in talks with Uzbekistan and Turkmenistan for supply of natural gas. India is very much interested in joining the TAP (Turkmenistan-Afghanistan- Pakistan) pipeline to make it a TAPI alignment. Discussions are on regarding pricing and security arrangements.

However, one success story in the past two years that has regional implications as well is definitely Indian FDI in textiles in Uzbekistan where one Indian company has emerged as the largest investors in that country. Spentex Textiles has already invested close to $ 100, making it the fourth or fifth largest private investor in that country. This company exported something like $ 85 million of cotton yarn to markets around the world from Uzbekistan and now employs close to 4500 local people, making it perhaps amongst the largest private sector employers there.

In so far as regional bodies here are concerned, India has been an observer to the Shanghai Cooperation Organisation (SCO) for the past three years. The objectives of the SCO especially those relating to combating the three isms–terrorism, extremism and separatism—are of great significance to India as well and given the cross-border support these scourges receive, India’s strategy in these areas can undoubtedly benefit from coordinated efforts with SCO founder-members. SCO is also now speaking of regional cooperation in both energy and water resources, in both of which India has an important stake. Full membership for India (and perhaps other countries like Pakistan, Mongolia and Iran) will probably be clearer next year. The Russian Prime Minister has extended an invitation to the Indian Prime Minister to attend next year’s SCO summit.

I just mentioned Afghanistan. I should say here that India is the fifth largest contributor of development assistance to that country. It has pledged a total of almost $ 1.2 billion to be spent between 2004 and 2012 in power, roads, government buildings and other civic infrastructure. In addition, India’s disbursement ratio is perhaps the highest amongst all donor countries and reflects the great importance that India places on the reconstruction of Afghanistan.

V

No discussion of India in Asia can be complete without bringing in West Asia as we see it or the Middle East as the Americans and Europeans see it. Incidentally, the ancient Greeks had this region in mind when they first coined the word “Asia”. This is again not just a region with which India shares very close cultural and historical ties. This is not just a region from where India gets almost three-fourths of her crude oil requirements. It is also a region in which close to 4 million Indians work. They are part of the large Indian remittance economy.

In 2007/08, remittances to India were around $ 28 billion, of which around one-third is estimated to have come from this region alone. As a proportion, the contribution of West Asia to remittances has no doubt declined because of the growth in movement of skilled professionals to the USA mainly (to H-1B or not to H-1B types).But in terms of their significance to local economies, of which the state of Kerala is the most outstanding example, remittances from West Asia are crucial. Remittances now account for around 20-25% of NSDP in Kerala but there have been years where the proportion has been closer to 30%. There are other regions like Hyderabad and Azamgarh in Uttar Pradesh which have been transformed, both economically and socially, by these remittances from West Asia.

India is in discussions with the Gulf Cooperation Council (GCC) for a FTA and the third round of talks is scheduled to be held in New Delhi early next year. In addition, India’s Prime Minister Dr. Manmohan Singh has just completed a visit to Oman and Qatar in which investment was a major focus. India has already invested in a gas-based urea plant in Oman and is also importing LNG from Qatar. The idea now is to expand the engagement and explore opportunities for investment of Qatari petrodollars especially in Indian infrastructure projects. Discussions on the gas pipeline from Iran through Pakistan are also at an advanced stage mainly on pricing. India is serious about completing the negotiations soon.

VI

I want to touch very briefly on our growing ties with China since there is great interest in the two Himalayan neighbours who together will soon be accounting for around two-fifth of the world’s population. Three years back, I had coined the term “Chindia” to reflect the re-emergence of China and India on the world’s stage after a long gap of almost four centuries and to suggest that the world is big enough to accommodate both China and India. China is already India’s largest single-country trading partner. In 2007/08, India’s exports to China amounted to around $ 11 billion, while imports were at about $ 29 billion. India’s exports to China are dominated by iron-ore and the big challenge will be to develop new exports if the growing trade deficit is not to become a political issue in India.

Indian companies complain of opaque regulations particularly in areas like agriculture and pharmaceuticals. These are being discussed bilaterally. China has been keen that India grant it “market economy” status and also enter into a FTA. Indian companies are investing in China in areas like auto components, pharmaceuticals, chemicals and IT although the volume of investment is still not too large and is perhaps close to $ 80 million. Chinese companies too have made investments in India in consumer goods and telecom networking.

Many in the West see India and China as natural adversaries. Indeed, our political and social systems are profoundly different. Indeed, there is competition between the two. But to think that all competition will lead to confrontation is to misread the dynamics in both countries. In fact, both countries are cooperating in the oil and gas sector in Sudan, Syria and Colombia. The Kunming initiative involving the province of Yunnan, Myanmar, India and Bangladesh is moving ahead and already a direct flight operates from Kolkata to Kunming. It appropriate that India became a formal member of ASEM in Beijing last month.

While on the alphabet soup of regional groupings, I should also say that India’s application for membership of APEC has been pending for twelve years now. Last time around, if I recall right Japan pushed for Peru and the USA canvassed for Vietnam. It seems to me that when the membership issue is reopened in two years time, India’s case can be ignored only at APEC’s own cost. Further, at the Second East Asia Summit (EAS) held at Cebu in January 2007, a Track-II study group was launched to examine the feasibility of a Comprehensive Economic Partnership of East Asia (CEPEA) combining ASEAN+6 economies (ASEAN, China, Japan, South Korea, India, Australia and New Zealand) India strongly feels that such a CEPEA combining ASEAN+6 economies would be an important step towards a broader pan-Asian regional community which Prime Minister Dr. Manmohan Singh elaborated at the first EAS Summit at Kuala Lumpur in December 2005. I understand that the Track-II study group will present its preliminary report at the next EAS Summit in a about three weeks time at Chiang-Mai. There is some debate on whether ASEAN+3 is a better forum for evolving a broader scheme of economic integration in Asia. This has influential champions in the region. However, we believe, and this is borne out by ADB’s own studies, that the EAS framework has greater potential to generate far greater all-round welfare gains.

VII

Ladies and Gentlemen, I am coming to the end of my tour d’horizon of India in its regional setting. India’s economic strategy adopted in the fifties had a compelling logic. That strategy served a country of India’s historical legacy and size, a society of India’s diversity and complexity well. It had a certain context and imperative which tend to get forgotten in post-mortems. But over the past two decades or so, fundamental reorientations have been carried out in economic policy which have given India new resilience and strength. The global crisis will certainly affect India even though our approach to financial liberalisation has been prudent and nuanced. However, what is remarkable is that the commitment to engaging the region in its larger context and the world remains unshakeable.

India will proceed with regional integration with even greater vigour whatever the vicissitudes in the next couple of months and perhaps even a couple of years. India stands prepared to make unilateral moves as indeed it has done. India stands prepared to deepen the bilateral engagement with each of the countries in the Asian region as indeed has been happening. India stands prepared to work with regional institutions as well. India’s emergence in the Asian region presents to it not just new opportunities and challenges but will also impose on it new roles and responsibilities. India stands prepared to shoulder them. But I also must admit here that at times India’s security concerns, I might add, preclude it from agreeing to proposals that may appear to be eminently reasonable at first sight. These concerns cannot be brushed aside. Economic integration simply cannot be sustained if these concerns are denied and if these are not addressed in a demonstrably tangible manner

The current global economic crisis presents new opportunities for us in Asia. Two years ago, after a discussion with the ESCAP Secretary General, I had commissioned a New Delhi-based think tank to work with counterpart institutions in other Asian countries and prepare a detailed blueprint for an Asian Infrastructure Bank or an Asian Infrastructure Finance Corporation with focus of financing cross-border infrastructure particularly. That report was released in March 2007 and was discussed in the ESCAP Ministerial Meeting held earlier this April in Bangkok. One option suggested in the study was for the new financing institution to be an ADB-affiliate akin to the IFC vis-a-vis the World Bank. New ideas need the right time and the current situation makes the time ripe for such a bold initiative.

Another idea whose time may have come is that of a new financial architecture in Asia. In the wake of the 1997 East Asian crisis, Japan had proposed an Asian Monetary Fund but this had to be abandoned for well-known reasons. Eventually a more modest Chiang-Mai initiative (CMI) was launched by the ten ASEAN countries and China, Japan and South Korea (ASEAN+3) to provide liquidity assistance to countries in difficulty through a system of bilateral swaps. Subsequently these bilateral swaps have been multilateralized into a pool of about US$ 80 billion of which only 20% can be drawn without invoking IMF’s conditionalities. However, there are many limitations of this arrangement. In the current context a more profound and bolder approach needs to be considered not only to provide balance-of- payments support to the member countries in crisis periods but also to create a unit of account namely Asian currency unit (ACU) for facilitating intraregional trade by moderating the exchange rate volatility between region’s currencies. This bolder approach should cover all EAS countries before eventually being extended to cover other Asian countries to make it truly a regional lender of last resort.

VIII

Before closing, I must acknowledge that economic integration, especially FTAs, necessarily involve trade-offs and compromises. There are undoubtedly macro gains to be had but there are also, to be sure, micro pains that could well be inflicted. These costs would be borne by specific industries, specific livelihoods and specific regions. That is why adjustment assistance will become critical to sustain the political acceptability of FTAs and broader economic integration as well.

To give one example of what I mean, as a result of the India-ASEAN FTA Indian tea, coffee and pepper will face competitive threats from Vietnam particularly as duties reduce by 2018—in the case of tea and coffee from 100% to 45% and in the case of pepper from 70% to 50%. Advance action to enhance productivity in these sectors will have to be taken to ensure no negative fall-out from the FTA later. This is exactly what is being done. The ADB itself can play an important role in the design and implementation of such adjustment assistance programmes in member countries through what might be called an Asian Integration Adjustment Assistance Facility.

I thank the ADB, of which India was an important founding member forty two years ago, for giving me this opportunity to be with all of you today. The ADB has been playing an important intellectual role in spreading the gospel of regional integration. Two of its most recent publications—Emerging Asian Regionalism and Quantification of Benefits from Economic Cooperation in South Asia—are major contributions. That intellectual role will, I am sure, be backed by enhanced financial resources as well.